Equifax Credit Score Range: Your Ultimate Guide

Table of Contents & FAQ

- Introduction

- 5 Key Aspects of Equifax Credit Score Range

- Case Studies

- Common Mistakes to Avoid

- Alternatives to Equifax Credit Score Range

- Frequently Asked Questions

- Quick FAQ

- What is the Equifax credit score range?

- How does Equifax differ from Experian and TransUnion?

- What’s a good Equifax credit score?

- How can I improve my Equifax score?

- What’s the Canadian Equifax credit score range?

- How often should I check my Equifax score?

- What affects my Equifax credit score range?

- Can errors lower my Equifax score range?

- How does Equifax score range impact loans?

- What’s the average Equifax score in 2025?

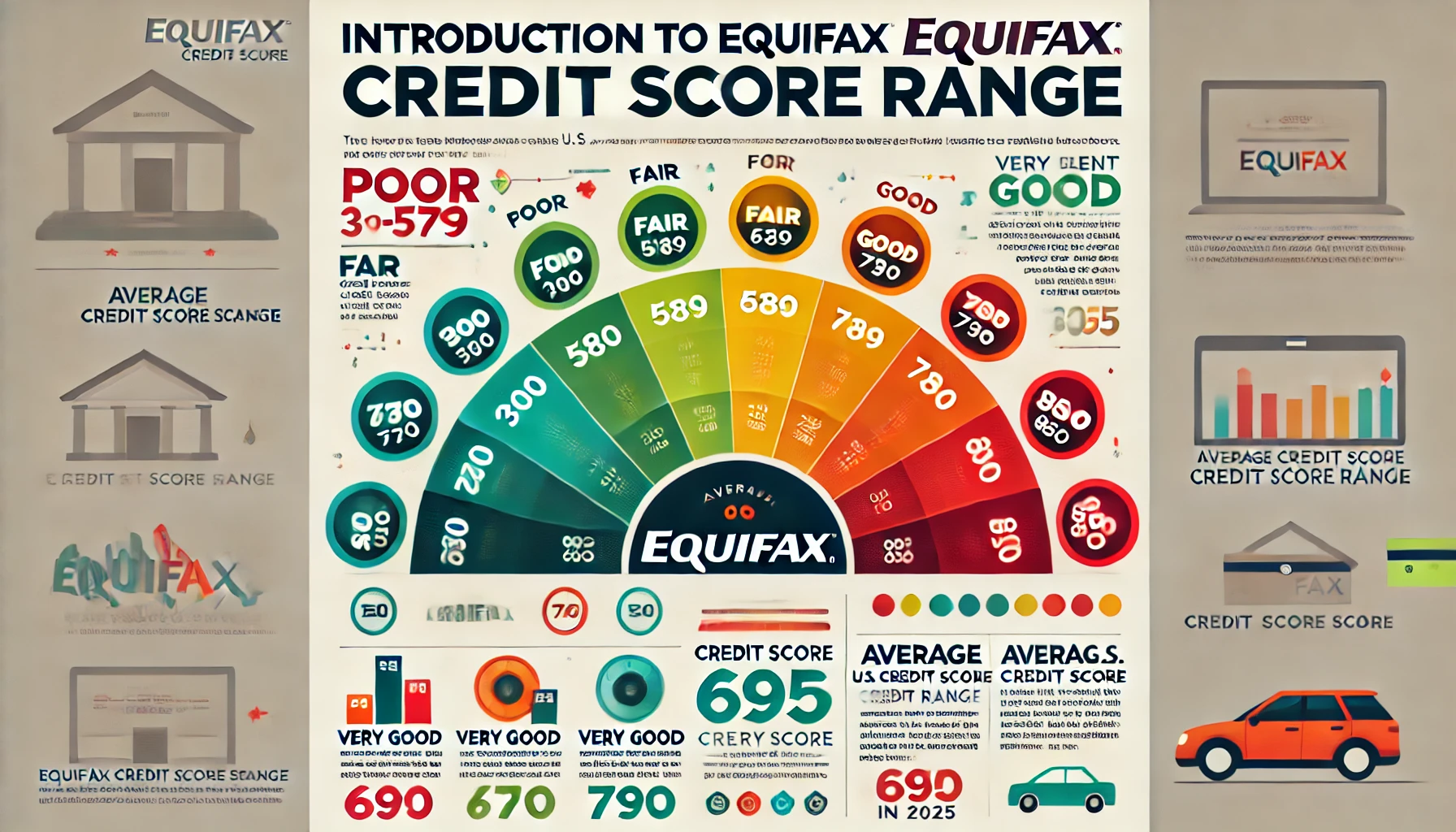

Introduction to Equifax Credit Score Range

The Equifax credit score range is a cornerstone of financial literacy in 2025. As one of the three major credit bureaus in the United States—alongside Experian and TransUnion—Equifax provides a numerical snapshot of your creditworthiness, typically ranging from 300 to 850 under the widely adopted FICO scoring model. This range isn’t just a number; it’s a gateway to loans, credit cards, and better interest rates. According to recent Equifax data, the average U.S. credit score in 2025 sits at approximately 695, a slight uptick from 690 in 2020, reflecting broader access to credit education and tools.

Historically, Equifax has played a pivotal role since its founding in 1899 as a credit reporting agency. Today, it processes data for millions, influencing everything from mortgage approvals to car leases. A score in the “excellent” range (800-850) can save you thousands in interest, while a “poor” score (below 580) might limit your options significantly. Understanding where you stand within the Equifax credit score range is the first step toward financial control. In this guide, we’ll explore its mechanics, compare it to other bureaus, and offer practical strategies to boost your score—whether you’re a beginner or a credit veteran.

Why does this matter now? With rising interest rates and economic shifts in 2025, a strong credit score is more valuable than ever. This article dives deep into the Equifax score range, addressing common questions and providing actionable insights to help you navigate your financial journey.

5 Key Aspects of Equifax Credit Score Range

1. Understanding the Equifax Score Scale

The Equifax score scale operates on a 300-850 spectrum. Here’s the breakdown: 300-579 is poor, 580-669 is fair, 670-739 is good, 740-799 is very good, and 800-850 is excellent. Each band signals your risk level to lenders. For instance, a score of 720 might secure a 4% mortgage rate, while 620 could bump it to 6%, adding $50,000 in interest over 30 years. Real-world example: Jane, a 28-year-old nurse, moved from 650 to 710 by paying off a small loan, qualifying her for a better car loan. Knowing these tiers helps you set tangible goals and track progress.

Beyond numbers, the scale reflects behavior. A “good” score shows consistent payments, while “excellent” often requires years of discipline. Check your standing with Equifax’s free tools to see where you fit and what’s possible.

2. Factors Affecting Your Equifax Score

Your Equifax score hinges on five pillars: payment history (35%), credit utilization (30%), length of credit history (15%), new credit (10%), and credit mix (10%). Missing a single payment can slash your score by 50-100 points—John, a freelancer, saw his drop from 740 to 680 after a late utility bill. Conversely, keeping utilization under 30% can lift it. For example, paying a $3,000 balance on a $10,000 limit card boosts your score noticeably.

Longevity matters too. A 10-year-old account outweighs a new one. Opening multiple accounts quickly, however, triggers inquiries that nibble away points. Diversifying with a mortgage and credit card can help, but balance is key. Regularly reviewing your Equifax report catches inaccuracies—like a false $500 debt—that could skew your score.

3. Comparing Equifax to Experian and TransUnion

The Equifax credit score range aligns with the Experian credit score range and TransUnion credit score range, all pegged at 300-850 via FICO. Yet, differences emerge. Equifax might log a late payment Experian misses, creating a 20-30 point gap. TransUnion could prioritize recent activity more, shifting your score slightly. For instance, Maria’s Equifax score was 690, but her Experian hit 715 due to unreported debt.

Why the variance? Each bureau collects data independently. Lenders may report to one but not all, so checking all three via AnnualCreditReport.com offers a complete view. This triangulation helps you spot errors and understand your true credit standing across the board.

4. Tools to Monitor Your Equifax Score

Equifax provides free tools like Credit Monitor, updating your score monthly. Third-party apps like Credit Karma pair Equifax and TransUnion data, while MyFICO offers all three for a fee. Example: Tom used Credit Karma to catch a $1,200 error on his Equifax report, fixing it in 30 days. Pair these with your free annual report from AnnualCreditReport.com for a robust strategy.

Monitoring isn’t just reactive. Set alerts for score drops or new accounts—identity theft hit 1.4 million Americans in 2024, per Equifax. Proactively tracking your Equifax score range keeps you ahead of issues and informed for big financial moves like buying a home.

5. Improving Your Equifax Credit Score Range

Boosting your score starts with basics: pay on time, every time—automation helps. Lower utilization by paying down balances; dropping from 50% to 20% on a $5,000 limit could add 30-50 points. Example: Lisa raised her score from 660 to 720 in six months this way. Requesting a higher credit limit (without spending more) also works.

Dispute errors fast—Equifax processes corrections online. Avoid new credit unless needed, and keep old accounts open for history. Small steps compound: adding a secured card or becoming an authorized user on a trusted account can nudge your score up over time.

Case Studies: Real-World Equifax Score Examples

Case Study 1: From Fair to Good

Sarah, a 32-year-old teacher, had an Equifax score of 640 in 2023. High credit card balances (70% utilization) dragged her down despite timely payments. She paid off $4,000 over six months, dropping utilization to 25%. By mid-2024, her score hit 710, qualifying her for a lower-rate car loan. Key takeaway: Tackling utilization can transform your range fast.

Case Study 2: Canadian Equifax Success

Amit, a 40-year-old Toronto IT worker, started at 590 on the Canadian credit score range (300-900). High debt and frequent inquiries hurt him. He consolidated loans, avoided new credit, and paid on time. In 14 months, his score reached 750. Key takeaway: Discipline pays off, even with a broader range.

Case Study 3: Error Correction Win

Mike, a 45-year-old U.S. retiree, saw his Equifax score plummet to 620 in 2024. A $2,000 debt he’d paid off was misreported. He disputed it via Equifax’s portal with proof of payment; within 45 days, his score rebounded to 760. Key takeaway: Vigilance can reverse setbacks.

Case Study 4: Building from Scratch

Emma, a 23-year-old graduate, had no score in 2023. She got a secured card with a $300 limit, used it lightly, and paid it off monthly. By 2025, her Equifax score was 680—solid for a beginner. Key takeaway: Starting small builds a foundation.

Common Mistakes to Avoid with Equifax Credit Score Range

Ignoring your Equifax report is a costly error. A 2024 study found 20% of reports have inaccuracies—like a duplicate $800 loan—that can tank your score by 50+ points. Maxing out cards is another trap; 90% utilization screams risk to lenders, even if paid off later. Example: Paul’s score fell from 720 to 670 after holiday overspending.

Applying for multiple loans in a month racks up inquiries, each shaving 5-10 points. Closing old accounts shortens your history, too—keeping a 15-year card open, even unused, preserves your range. Lastly, skipping disputes delays recovery; a $300 error cost Jane 40 points for a year until fixed. Check your Equifax score range monthly to sidestep these pitfalls.

Alternatives to Equifax Credit Score Range

Experian Credit Score Bands

The Experian credit score bands (300-850) match Equifax’s FICO range but may demand a longer history for “excellent” (800-850). Experian might overlook a small debt Equifax catches, giving a rosier score. Example: Mark’s Experian was 745, but Equifax was 720 due to a late payment. Comparing both highlights discrepancies to fix.

TransUnion Credit Score Scale

The TransUnion credit score scale (300-850) weighs recent activity heavily. A missed payment might drop it faster than Equifax—Lisa saw a 30-point hit on TransUnion versus 20 on Equifax. It’s ideal for tracking short-term changes but requires consistency. Cross-check all three for accuracy.

VantageScore as an Alternative

VantageScore, used by all three bureaus, ranges from 300-850 but scores differently. It prioritizes payment history (40%) and utilization (20%), often giving newer credit users a boost. Example: Tom’s VantageScore was 700, while his Equifax FICO was 680. It’s a useful benchmark alongside Equifax.

Frequently Asked Questions

What is the Equifax credit score range?

The Equifax credit score range is 300-850 under the FICO model. Below 580 is poor, 580-669 is fair, 670-739 is good, 740-799 is very good, and 800+ is excellent. It’s a snapshot of your credit risk, guiding lenders on loan approvals. Knowing it helps you plan financial moves.

How does Equifax differ from Experian and TransUnion?

All three use a 300-850 range, but data varies. Equifax might report a $200 debt Experian skips, shifting your score. TransUnion emphasizes recent activity more. Example: Ana’s Experian credit score range was 710, but Equifax was 690 due to an old account. Check all for clarity.

What’s a good Equifax credit score?

A “good” Equifax score is 670-739. It opens doors to decent loans, though 740+ unlocks premium rates. Example: A 680 score got Sam a 5% car loan, while 750 could’ve dropped it to 3.5%. Aim for “very good” for the best deals.

How can I improve my Equifax score?

Pay on time, reduce utilization below 30%, and dispute errors. Paying off a $2,000 balance on a $5,000 limit could add 40 points in months. Avoid new credit unless needed, and keep old accounts active. Small habits—like autopay—build steady gains.

What’s the Canadian Equifax credit score range?

The Equifax Canada credit score range is 300-900. Below 560 is poor, 660-724 is good, and 800+ is excellent. It’s broader than the U.S. range, reflecting Canada’s credit culture. A 700 score there mirrors a 720 in the U.S. for loan eligibility.

How often should I check my Equifax score?

Check monthly via Equifax tools or apps like Credit Karma. Frequent monitoring catches errors—like a $1,000 misreported debt—early. AnnualCreditReport.com offers a yearly deep dive. Example: Kim spotted fraud in 2024, saving her score from a 100-point drop.

What affects my Equifax credit score range?

Payment history (35%), utilization (30%), history length (15%), new credit (10%), and mix (10%) drive it. A late payment cuts deep, while low balances lift it. Example: Max’s score rose from 650 to 700 by paying off $3,000 in debt over a year.

Can errors lower my Equifax score range?

Yes—20% of Equifax reports have errors. A $500 duplicate debt might drop you 50 points. Example: Lee’s score fell to 630 until he disputed a false charge, restoring it to 690. Review reports quarterly to catch and fix these.

How does Equifax score range impact loans?

A higher score means better terms. At 740, you might get a 4% mortgage; at 620, it’s 6%, costing $60,000 extra over 30 years. Lenders use your Equifax score range to gauge risk, so improving it saves money long-term.

What’s the average Equifax score in 2025?

The average Equifax score in 2025 is 695, up from 690 in 2020. It reflects growing credit awareness. Aiming for 700+ puts you above average, boosting approval odds for loans and cards.

| Credit Bureau | Score Range | Good Range | Excellent Range |

|---|---|---|---|

| Equifax (U.S.) | 300-850 | 670-739 | 800-850 |

| Experian | 300-850 | 670-739 | 800-850 |

| TransUnion | 300-850 | 670-739 | 800-850 |

| Equifax (Canada) | 300-900 | 660-724 | 800-900 |

Download our free Equifax credit score range chart template to map your progress and compare with Experian and TransUnion!

In closing, the Equifax credit score range is your financial compass. By mastering its components, sidestepping errors, and using smart tools, you can climb from “fair” to “excellent” and unlock a world of opportunities. Start today—your future self will thank you.

Disclaimer: This article is for informational purposes only. The content provided does not constitute professional advice. Readers should consult qualified professionals before making decisions based on the information in this article.