Capital Gain Amount: Calculate Your Gain Accurately

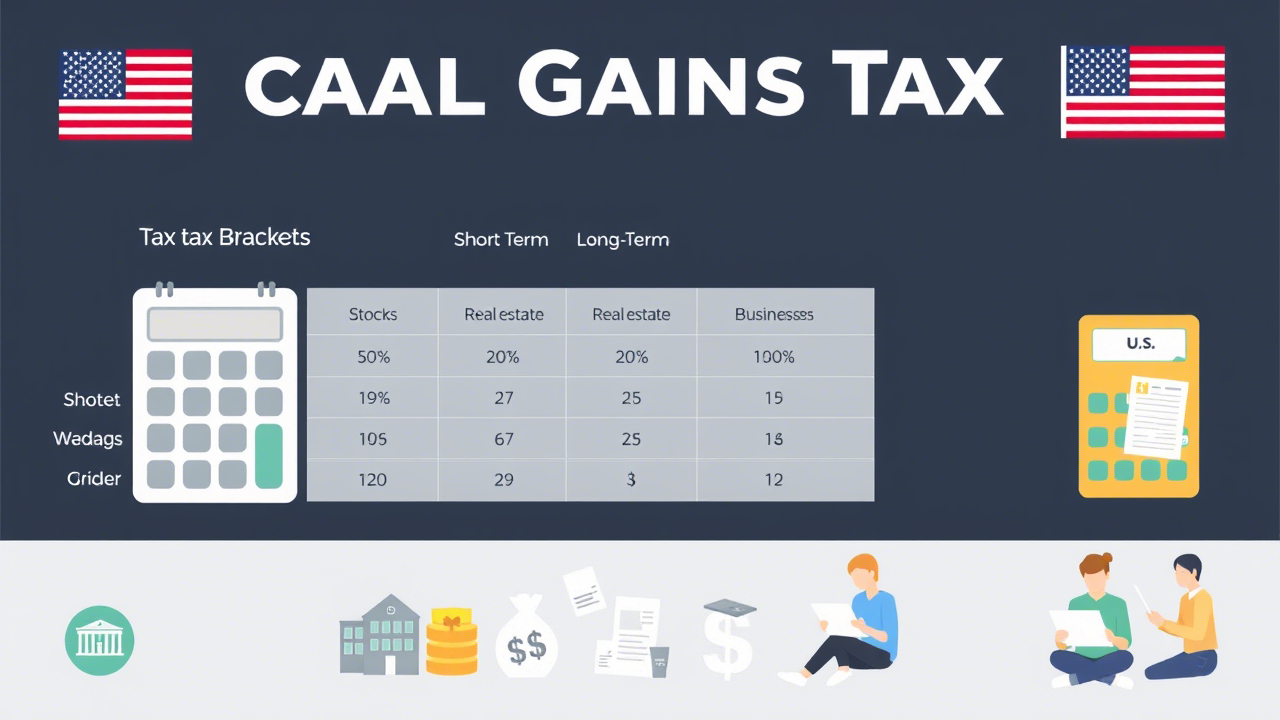

[capital gain amount]: Calculating Your Capital Gain Accurately Understanding how to calculate your [capital gain amount] is a crucial step whenever you sell an asset, whether it’s real estate, stocks, or other investments. This amount isn’t the tax you pay, but rather the profit you made from the sale, which is then subject to capital … Read more